Entrevistas e Editoriais

Por que as plataformas de iGaming estão investindo pesado em mercados emergentes

Quando o setor de iGaming na Europa atingiu sua maturidade, os operadores poderiam ter aceitado um crescimento mais lento. Mas, em vez disso, eles “fizeram as malas” e migraram para mercados emergentes—regiões repletas de potencial, mas igualmente cheias de complexidades. Imagine trocar uma estrada asfaltada por uma trilha off-road: imprevisível, emocionante e com chances de ser muito mais lucrativa.

Mas o que está por trás dessa mudança? Vamos analisar os dados, explorar as estratégias e destacar os obstáculos que se colocam entre as plataformas de iGaming e sua próxima grande vitória.

1. O Jackpot dos Mercados Emergentes: Por Que Todos Querem Uma Fatia #

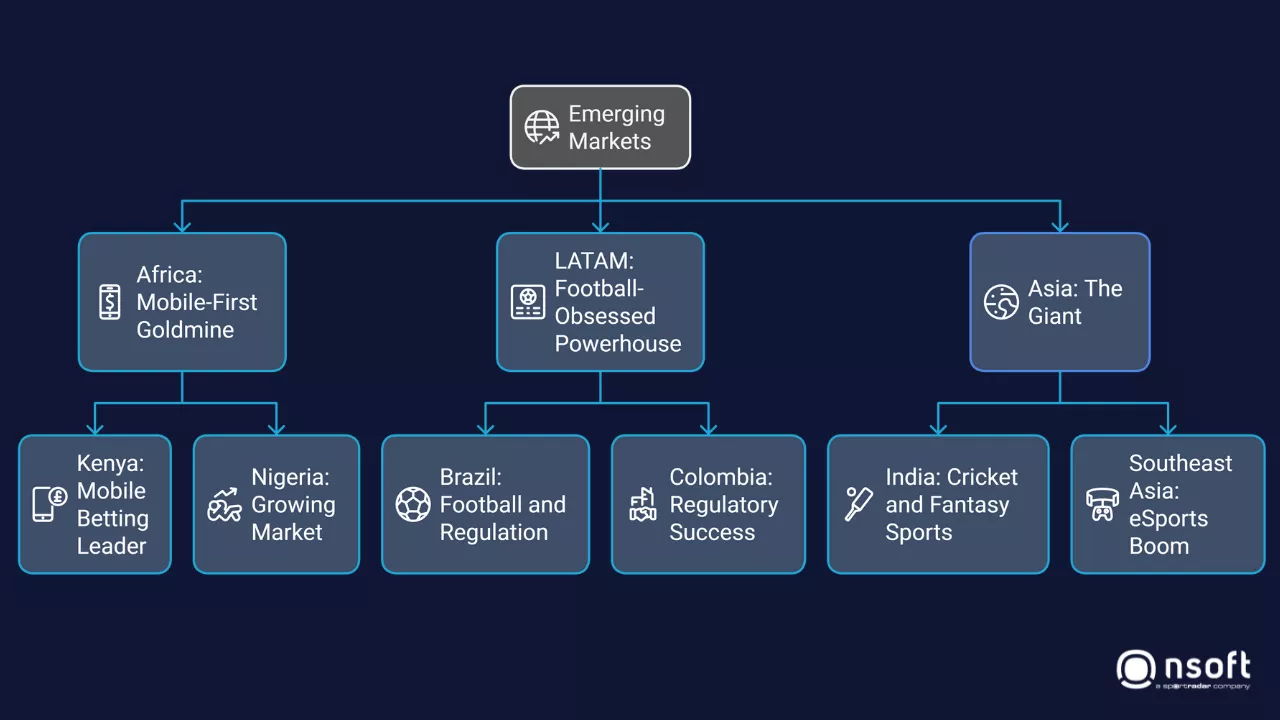

Enquanto Europa e América do Norte enfrentam um crescimento mais lento, regiões como África, América Latina e Ásia oferecem um nível totalmente novo de oportunidades. Mas não se trata apenas de expandir por expandir—os mercados emergentes apresentam a tempestade perfeita de condições para que o iGaming prospere.

África: Um Tesouro Móvel #

A África é um exemplo clássico de avanço tecnológico por “saltos”. Esqueça cartões de crédito ou internet de fibra óptica—o continente foi direto para o uso de dispositivos móveis. Até 2025, a penetração da internet móvel na África Subsaariana deve alcançar 50%, de acordo com a GSMA, tornando os smartphones o principal meio de acesso para milhões de pessoas entrando na economia digital.

O Quênia lidera essa revolução. De acordo com a Geopoll, 88% das apostas no país são feitas por meio de plataformas móveis, graças à integração perfeita com carteiras digitais como o M-Pesa. O domínio da Safaricom no setor de pagamentos transformou os smartphones em verdadeiros bancos portáteis.

A Nigéria não fica atrás. A Statista projeta que o mercado de apostas online do país atingirá US$ 110 milhões até 2025, impulsionado por uma população jovem, conectada e apaixonada por esportes.

Curiosidade: O evento de apostas mais popular na África? Jogos de futebol da Premier League inglesa—Manchester United e Arsenal possuem verdadeiras legiões de fãs devotos.

LATAM: A Potência Obcecada por Futebol #

A América do Sul, especialmente o Brasil, está se tornando um dos mercados mais empolgantes para o iGaming. Não é apenas pelo tamanho (212 milhões de pessoas); é porque o Brasil vive e respira futebol, a essência da indústria de apostas no país.

Com a legalização das apostas esportivas em 2023, o mercado de jogos online no Brasil deve atingir impressionantes US$ 2,39 bilhões até 2025. No entanto, entrar nesse mercado não é como marcar um gol de pênalti—os operadores precisam lidar com regulamentações rigorosas, incluindo parcerias obrigatórias com empresas locais e um processo de licenciamento exigente. Para os novatos, é um grande desafio, mas as recompensas são indiscutivelmente valiosas.

A Colômbia é o exemplo perfeito de sucesso regulatório na LATAM. Desde a introdução de seu modelo de licenciamento em 2016, o país atraiu 15 operadores internacionais, e seu mercado deve alcançar US$ 2,03 bilhões até 2029.

Insight importante: Brasil e Colômbia exigem mais do que apenas plataformas focadas em futebol. Os operadores precisam incorporar métodos de pagamento culturalmente relevantes, como o boleto bancário (no Brasil), e sistemas seguros baseados em dinheiro para conquistar a confiança dos consumidores.

Ásia: O Gigante Que Exige Precisão #

A Ásia é tão vasta quanto complexa. Com 4,8 bilhões de pessoas distribuídas em países extremamente diversos, nenhuma estratégia única funciona aqui. Em vez disso, os operadores precisam adaptar suas ofertas às preferências regionais.

As apostas esportivas—especialmente no críquete—dominam na Índia. O país também se tornou o maior mercado de esportes de fantasia do mundo, com plataformas como Dream11 prosperando mesmo sob leis restritivas de jogos. Formatos baseados em habilidades encontraram seu espaço nessa zona cinzenta legal, impulsionando o mercado de apostas online para um valor projetado de US$ 3,2 bilhões até 2025.

Sudeste Asiático: Países como as Filipinas e o Vietnã estão vivenciando um boom nas apostas em eSports, impulsionado por uma demografia jovem e conectada primeiro pelos dispositivos móveis. Ao mesmo tempo, os cassinos físicos continuam crescendo em toda a região. O mercado de jogos online no Sudeste Asiático deve atingir US$ 1,34 bilhão até 2025, refletindo o apetite crescente por entretenimento digital.

Desafio: O cenário regulatório fragmentado da Ásia significa que os operadores precisam lidar com um verdadeiro mosaico de sistemas legais. Na Índia, o que é legal em um estado pode te colocar em apuros em outro

2. Desafios: Por Que Apostar em Mercados Emergentes Não É Para Todos #

Os mercados emergentes podem soar como uma mina de ouro fácil, mas a realidade é bem mais complicada. Os operadores precisam superar uma série de desafios que vão desde ambiguidades regulatórias até lacunas na infraestrutura.

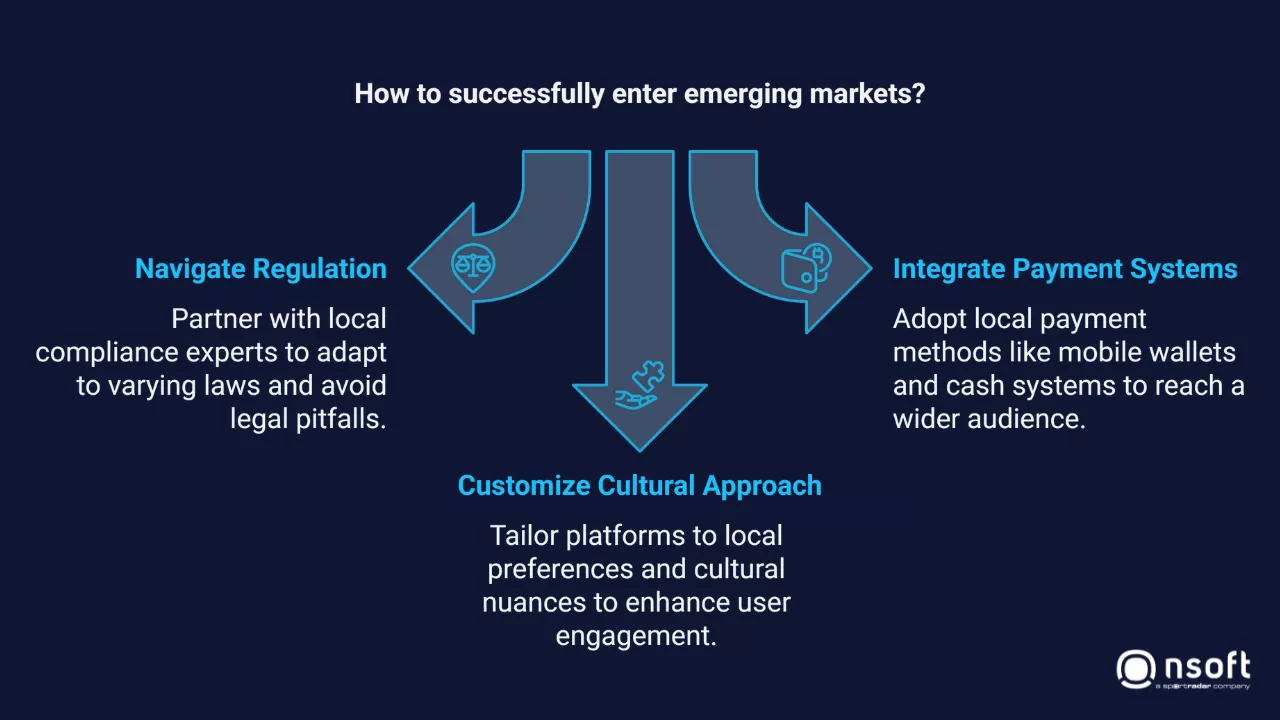

A Roleta das Regulamentações #

África: As leis variam significativamente entre os países. A África do Sul possui diretrizes claras para apostas esportivas, mas mercados como Nigéria e Quênia frequentemente enfrentam aumentos repentinos de impostos ou mudanças nos marcos legais.

LATAM: As licenças para apostas esportivas no Brasil são limitadas e caras, com exigências de formação de parcerias locais. Na Argentina, as regulamentações variam de província para província—Buenos Aires opera de forma independente em relação às jurisdições vizinhas.

Dica profissional: Operadores bem-sucedidos fazem parcerias com especialistas locais em conformidade para se antecipar às mudanças regulatórias. A NSoft, por exemplo, colabora com equipes jurídicas locais para garantir total conformidade antes do lançamento.

Infraestrutura de Pagamentos: O Fator Decisivo #

Os mercados emergentes não seguem as mesmas regras de pagamento da Europa ou da América do Norte. Se sua plataforma não consegue se integrar aos sistemas locais, você está fora do jogo.

África: As carteiras digitais dominam o mercado. Veja o M-Pesa do Quênia—ele detém impressionantes 93,4% do mercado de dinheiro móvel. Se sua plataforma não se integra ao M-Pesa, você basicamente está fechando as portas para uma enorme parcela de clientes.

LATAM: O Brasil ainda é muito adepto do dinheiro vivo. O boleto bancário continua sendo um dos principais meios de pagamento online, especialmente para consumidores sem cartão de crédito ou conta bancária. Enquanto isso, o Pix, o sistema de pagamentos instantâneos do Brasil, está crescendo rapidamente. Para ter sucesso aqui, é necessário adotar uma abordagem híbrida que conecte pagamentos em dinheiro e digitais.

Sudeste Asiático: As carteiras digitais dominam o jogo, especialmente entre os mais jovens. Nas Filipinas, o GCash lidera com mais de 20 milhões de usuários gerenciando desde contas até compras. Já na Índia, o Paytm está no topo com sua plataforma tudo-em-um. Essa transição para pagamentos digitais é impulsionada por uma população jovem, conectada e ávida por conveniência.

Personalização Cultural: Uma Estratégia Única Não Serve para Todos #

Você não pode simplesmente copiar e colar uma plataforma de apostas europeia e esperar que ela funcione na Nigéria ou no Peru. Os operadores precisam entender profundamente os hábitos locais de apostas, desde as preferências de jogos até as estratégias de marketing.

Exemplo: No Brasil, oferecer um bônus temático do Neymar ou aumentar as odds durante as eliminatórias da Copa do Mundo atrai muitas inscrições. Enquanto isso, no Quênia, apostas no estilo jackpot com taxas de entrada baixas são extremamente populares entre os usuários.

3. Histórias de Sucesso: Quem Está Fazendo Certo? #

NSoft na África #

A NSoft entrou no mercado africano adaptando suas plataformas B2B para usuários que priorizam dispositivos móveis e enfrentam limitações de banda larga. Ao focar em aplicativos leves e na integração perfeita com carteiras digitais, a NSoft se tornou uma parceira confiável em países como Namíbia e Lesoto.

Bet365 na LATAM #

A Bet365 conquistou o Brasil ao localizar suas opções de pagamento, contratar agentes de atendimento ao cliente que falam português e adaptar suas promoções para os fãs de futebol. Esse nível de adaptação fez dela uma das plataformas mais populares da região.

Dream11 na Índia #

Ao focar exclusivamente em esportes de fantasia, a Dream11 contornou as restritivas leis de apostas da Índia e se tornou líder de mercado. Seu sucesso destaca a importância de compreender as brechas legais locais.

Conclusão #

Os mercados emergentes não são para os avessos ao risco, mas, para os operadores dispostos a se adaptar, as recompensas são imensas. A combinação de populações jovens, rápida adoção digital e regulamentações em evolução cria a tempestade perfeita de oportunidades.

Mas ter sucesso aqui não significa replicar estratégias passadas—é preciso abraçar os desafios e as oportunidades únicas que cada região apresenta. Empresas como a NSoft já estão provando que, com as ferramentas certas, parcerias estratégicas e insights bem fundamentados, os mercados emergentes podem ser a base da próxima grande fase de crescimento do iGaming.

E então, você vai dar esse salto? O jogo já começou.

Tags:

Artigos Relacionados

Notícias

29.04.2025.

NSoft and InnovaPlay Strategic Partnership

The strategic collaboration integrates NSoft’s innovative sportsbook technology seamlessly into InnovaPlay’s comprehensive white-label and full web solution, empowering sportsbook operators to reach new heights of performance and player engagement.

Saiba mais

Notícias / Entrevistas e Editoriais

16.04.2025.

Beyond the Bet: How Gamification is Reshaping Online Gambling

By making the gamification elements fun, relevant, and optional, you ensure that they enhance the betting experience rather than overshadow it.

By Marko Galić, Game Mathematician & Project Manager at NSoft

Saiba mais

Não encontrou o que estava procurando?

Nossa equipe terá o prazer de guiá-lo por nossos produtos e serviços.

Contate-nos